4 Easy Facts About Feie Calculator Shown

Our Feie Calculator Statements

Table of ContentsAn Unbiased View of Feie CalculatorThe Feie Calculator StatementsSome Known Incorrect Statements About Feie Calculator The 9-Minute Rule for Feie CalculatorThings about Feie Calculator

Initially, he offered his U.S. home to develop his intent to live abroad completely and looked for a Mexican residency visa with his better half to help satisfy the Bona Fide Residency Test. Additionally, Neil safeguarded a long-lasting property lease in Mexico, with strategies to ultimately acquire a building. "I currently have a six-month lease on a house in Mexico that I can expand another six months, with the purpose to acquire a home down there." However, Neil explains that purchasing home abroad can be challenging without initial experiencing the location."We'll definitely be beyond that. Also if we come back to the US for medical professional's consultations or service calls, I doubt we'll invest greater than thirty day in the US in any type of offered 12-month period." Neil highlights the relevance of strict tracking of united state check outs (Digital Nomad). "It's something that people need to be truly attentive regarding," he claims, and advises expats to be careful of typical blunders, such as overstaying in the united state

Getting The Feie Calculator To Work

tax obligation responsibilities. "The reason U.S. taxes on around the world revenue is such a big bargain is since many individuals forget they're still subject to U.S. tax also after relocating." The U.S. is among the couple of nations that taxes its citizens despite where they live, meaning that even if a deportee has no revenue from united state

tax return. "The Foreign Tax Credit allows individuals working in high-tax countries like the UK to offset their U.S. tax liability by the amount they've currently paid in tax obligations abroad," claims Lewis. This ensures that deportees are not strained two times on the very same revenue. However, those in reduced- or no-tax nations, such as the UAE or Singapore, face additional hurdles.

The 6-Minute Rule for Feie Calculator

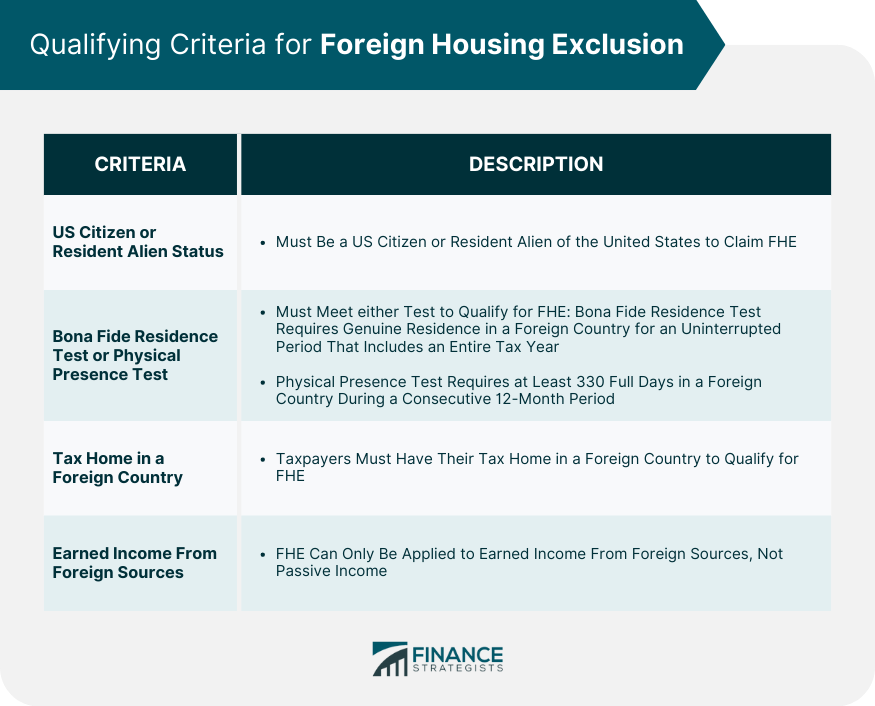

Below are some of the most often asked questions about the FEIE and other exemptions The International Earned Earnings Exclusion (FEIE) enables united state taxpayers to leave out approximately $130,000 of foreign-earned earnings from government income tax, reducing their U.S. tax liability. To get approved for FEIE, you should satisfy either the Physical Visibility Examination (330 days abroad) or the Bona Fide House Test (confirm your main home in a foreign nation for over here a whole tax year).

The Physical Existence Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Presence Test additionally requires united state taxpayers to have both a foreign income and a foreign tax obligation home. A tax home is defined as your prime place for organization or employment, regardless of your family's house.

Indicators on Feie Calculator You Should Know

A revenue tax obligation treaty in between the united state and an additional nation can assist protect against double taxation. While the Foreign Earned Income Exemption decreases taxable income, a treaty may provide fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a called for declaring for united state people with over $10,000 in international economic accounts.

Eligibility for FEIE relies on conference certain residency or physical presence examinations. is a tax obligation expert on the Harness system and the founder of Chessis Tax obligation. He is a participant of the National Organization of Enrolled Representatives, the Texas Society of Enrolled Agents, and the Texas Culture of CPAs. He brings over a years of experience benefiting Big 4 companies, suggesting expatriates and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness platform and the creator of The Tax Man. He has over thirty years of experience and currently specializes in CFO services, equity settlement, copyright taxation, cannabis tax and separation relevant tax/financial planning issues. He is a deportee based in Mexico - https://www.mixcloud.com/feiecalcu/.

The international made income exemptions, often referred to as the Sec. 911 exemptions, omit tax on salaries gained from working abroad. The exemptions make up 2 parts - a revenue exemption and a housing exemption. The complying with FAQs go over the benefit of the exemptions consisting of when both spouses are expats in a basic manner.

Feie Calculator Things To Know Before You Get This

The revenue exclusion is now indexed for rising cost of living. The maximum annual revenue exemption is $130,000 for 2025. The tax obligation benefit omits the revenue from tax at bottom tax rates. Formerly, the exemptions "came off the top" lowering revenue based on tax on top tax obligation prices. The exclusions may or might not lower revenue used for other purposes, such as IRA restrictions, child credits, personal exemptions, and so on.

These exclusions do not excuse the incomes from United States taxes yet just give a tax obligation decrease. Keep in mind that a single person working abroad for all of 2025 that gained concerning $145,000 with no other earnings will have taxable earnings decreased to no - properly the very same response as being "tax obligation complimentary." The exemptions are computed each day.